TSI MACD Indicator for MT4 – Trend & Momentum Signals for Reliable Trading

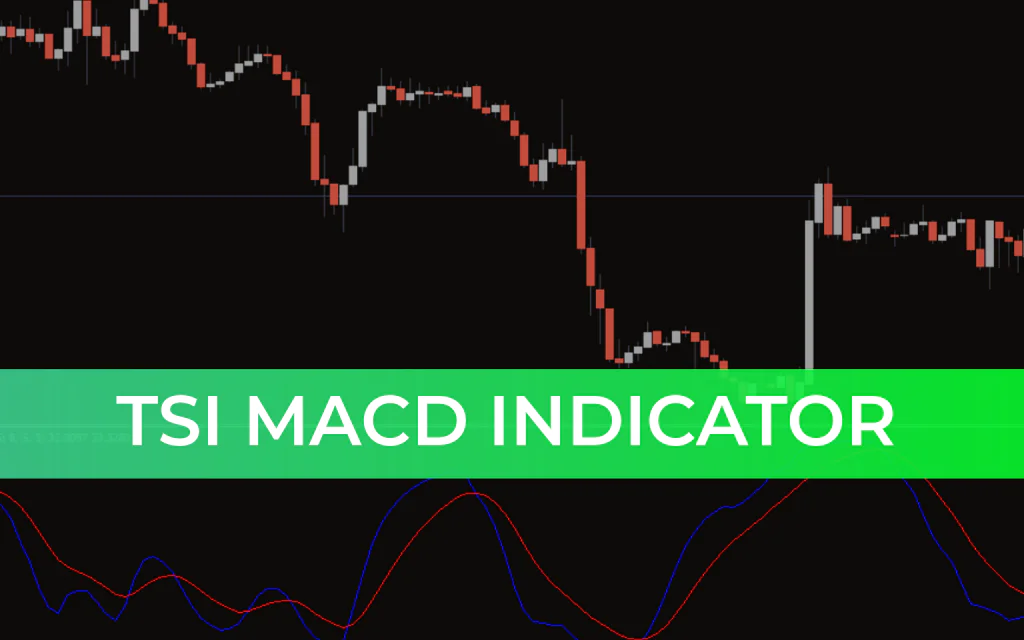

The TSI MACD Indicator for MT4 is a powerful combination of two popular technical indicators: the True Strength Index (TSI) and MACD. By combining these two tools, the indicator smoothens price fluctuations and provides more stable and reliable bullish and bearish signals than using MACD or TSI separately.

It is suitable for both new and experienced traders and works across all timeframes, from intraday charts to daily, weekly, and monthly charts. The indicator is free to download and easy to install.

Key Features

Combines TSI & MACD: Reduces false signals from market noise.

Reliable Trend Signals: Helps identify bullish and bearish trends.

Universal Timeframe: Works on intraday and long-term charts.

Beginner-Friendly & Advanced: Can be used alone or combined with Price Action for confirmation.

Zero Line Cross Method: Additional strategy for momentum-based trading.

How the TSI MACD Indicator Works

1. Crossover Signals

Buy Signal (Bullish): When the blue line crosses above the red line, the trend is bullish.

Entry: Go long at the next candlestick.

Stop Loss: Below the previous swing low.

Exit: When the blue line crosses back below the red line.

Sell Signal (Bearish): When the blue line crosses below the red line, the trend is bearish.

Entry: Go short at the next candlestick.

Stop Loss: Above the previous swing high.

Exit: When the blue line crosses back above the red line.

2. Zero Line Cross Strategy

Bullish Trend: Blue line crosses above the zero line.

Entry: Place a BUY order.

Stop Loss: Below the previous low.

Take Profit: When the red line crosses below the zero line.

Bearish Trend: Blue line crosses below the zero line.

Entry: Place a SELL order.

Stop Loss: Above the previous high.

Take Profit: When the red line crosses above the zero line.

Tip: Always confirm signals with Support And Resistance levels, trendlines, channels, and breakout levels for higher probability trades.

Benefits of Using TSI MACD Indicator

Trend Identification: Clearly shows bullish and bearish market conditions.

Momentum Confirmation: Reduces the risk of false signals by combining two indicators.

Versatile Trading: Suitable for swing trading, day trading, and position trading.

Easy to Interpret: Color-coded lines and crossovers make signals simple to read.

Conclusion

The TSI MACD Indicator for MT4 provides trend and momentum signals that are smoother and more reliable than standard MACD signals. By combining the True Strength Index with MACD, it helps forex traders identify bullish and bearish markets more accurately.

The indicator is free, easy to install, and effective across multiple timeframes. It is an essential tool for traders who want trend-following signals with reduced false entries.