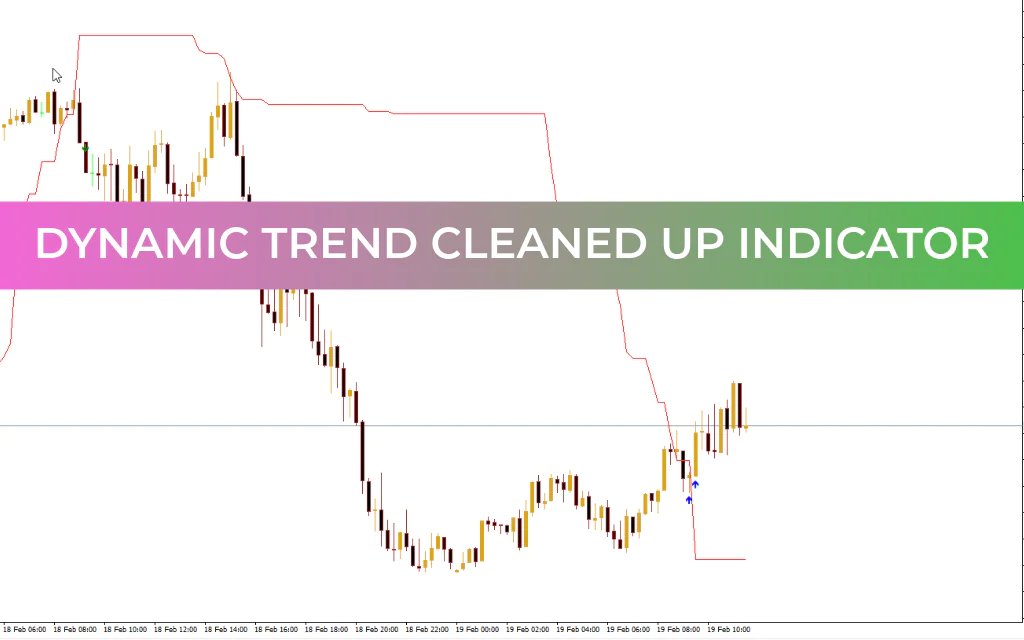

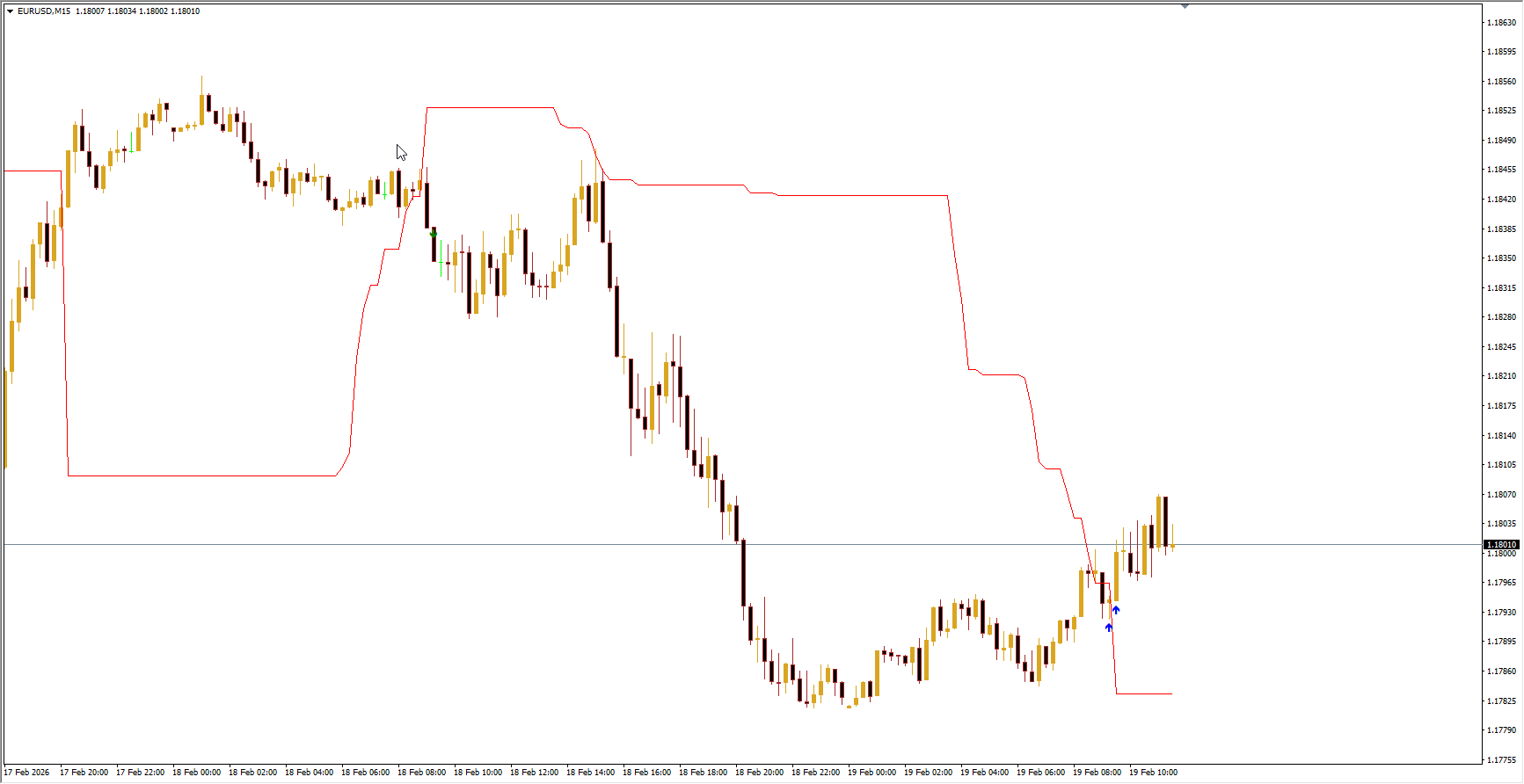

The Dynamic Trend Cleaned Up Indicator is a trend-following technical tool that plots an adaptive trendline to reflect the current market direction.

Unlike static trendlines, this indicator automatically adjusts to recent price movements, continuously repositioning itself in response to market changes. This dynamic behavior helps traders monitor Trend Strength and direction more effectively in real time.

The indicator can be applied to all timeframes, making it suitable for various trading styles. However, traders should be cautious when using it on lower timeframes, as market noise may produce false or less reliable signals.

How to Use the Dynamic Trend Cleaned Up Indicator in MT4

The indicator visually represents trend direction through its position relative to Price Action.

When the indicator moves above the price, it suggests a bullish trend.

When it moves below the price, it indicates a bearish trend.

The dynamic trendline can be used to identify potential entry and exit points:

If price crosses above the trendline during an uptrend, it may signal a potential buying opportunity.

If price falls below the trendline during a downtrend, it may suggest a potential selling opportunity.

Identifying Potential Market Reversals

The indicator can also help detect possible reversals:

If price begins to diverge from the trendline while the indicator continues following the existing trend, it may signal weakening momentum.

A price close below the trendline in an uptrend or above the trendline in a downtrend may indicate a potential Trend Reversal.

For improved reliability, traders often confirm signals using additional technical tools such as:

Moving averages

Support And Resistance levels

Other momentum or trend indicators

Conclusion

The Dynamic Trend Cleaned Up Indicator for MT4 provides a continuously adjusting trendline that reflects real-time market direction. By offering a clear visual representation of trend structure and potential reversal zones, it helps traders make more informed trading decisions and align positions with prevailing market momentum.